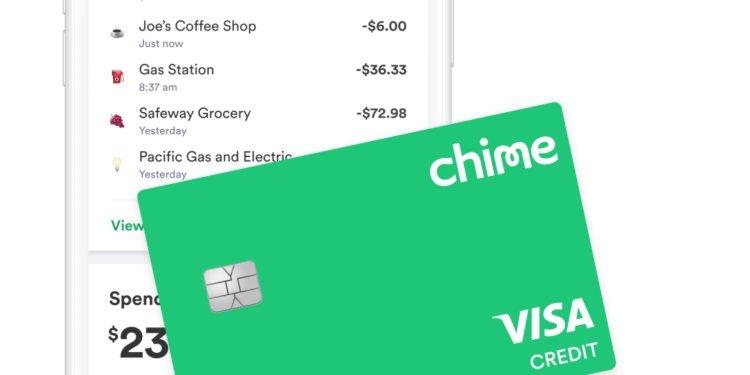

As predicted, ServiceTitan’s wildly successful IPO is beckoning other fintechs to maneuver ahead on their very own public debuts. Digital financial institution Chime has filed its confidential paperwork with the SEC, Bloomberg reports. It’s been prepping for this second because it employed banker Morgan Stanley in September, with an eye fixed to IPO in 2025.

The IPO gained’t actually be headed for actuality till that paperwork turns into public and institutional buyers agree to purchase in at a value that Chime needs. That might be a tall order. Chime was final valued at $25 billion when it raised $1 billion within the peak of the valuation frenzy of 2021, and has raised $2.65 billion whole, PitchBook estimates. Its buyers embrace Forerunner Ventures, Menlo Ventures, Crosslink Capital, Sequoia, SoftBank, Tiger International, and plenty of others.

Chime declined to remark.

Source link

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.