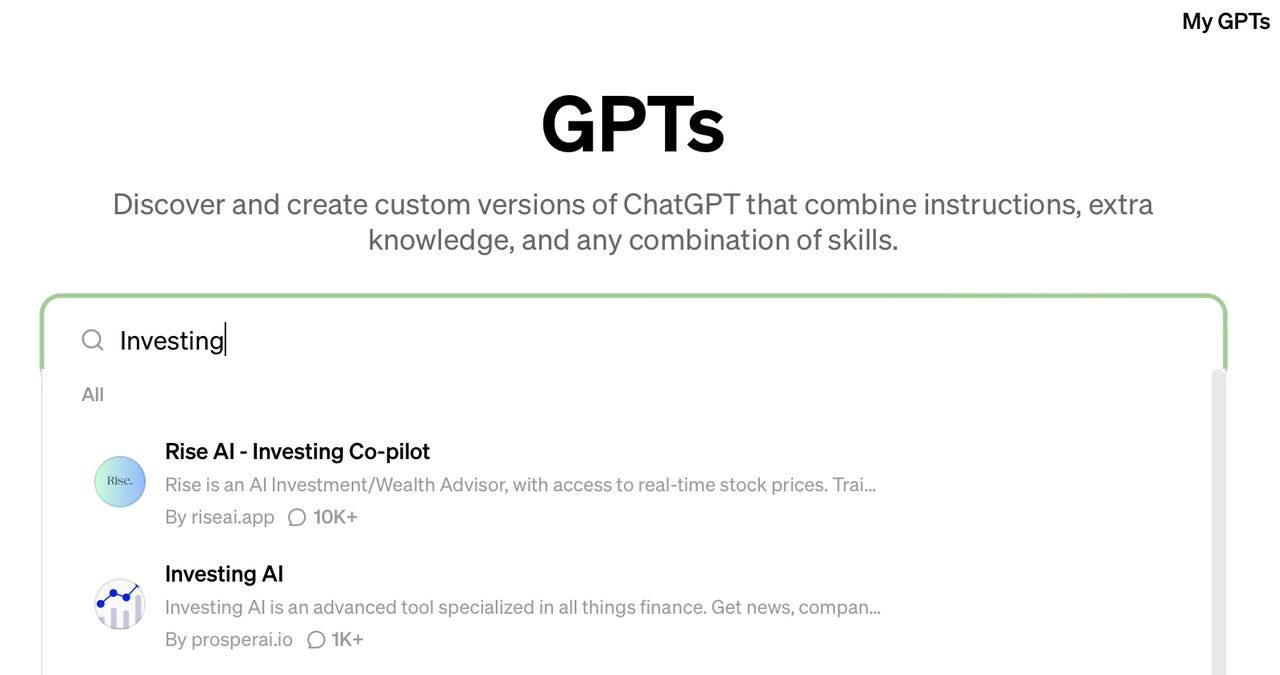

OpenAI’s GPTs market, investing GPTs.

Screenshot by Tiernan Ray/ZDNET

Individuals who put money into shares are intrigued by the prospect of synthetic intelligence revolutionizing inventory choosing, however the present expertise lags far behind what can be wanted to make clever decisions.

A evaluate of all of the stock-picking GPTs in OpenAI’s GPT market exhibits each one in every of them fails an very simple check that will be commonplace in an introductory finance or markets course, or a primary inventory investing seminar: They can not let you know if a inventory is dear or low cost.

Additionally: I asked Gemini and GPT-4 to explain deep learning AI, and Gemini won hands down

ZDNET evaluated all of the GPTs within the market by presenting them with an easy query: What’s the costliest tech inventory? The outcomes have been horrible throughout the board.

In case you are unfamiliar with inventory investing, the query of what is costly doesn’t imply which inventory worth is the very best in absolute {dollars}, Euros, or Renminbi. It means which inventory has the very best of one in every of a number of inventory valuation metrics. Normally, that metric is a ratio, resembling the value of the shares listed in the intervening time divided by some piece of monetary knowledge.

The most typical ratio is “P/E,” which stands for the value divided by the earnings that an organization has generated per share. For instance, Apple makes $6.67 per share in internet revenue, yearly. In the event you divide that into Apple’s current inventory worth, $199.20, what you get is a P/E of 30 ( $199.20 divided by $6.67).

Asking whether or not a inventory is reasonable or costly based mostly on a ratio can contain evaluating it to different corporations’ P/Es, or evaluating it to how that ratio has modified over time — if it is gotten larger or decrease — and different approaches. Any rookie inventory picker is aware of that inventory valuation is predicated on these sorts of measures, reasonably than merely how excessive the value occurs to be. (For extra element on inventory valuation, see ZDNET’s primer on stock investing.)

ChatGPT, and the assorted GPTs, do not know that primary truth. Each single one in every of them solutions in the identical clueless method. They largely cite the current inventory worth of Berkshire Hathaway, the corporate run by billionaire investor Warren Buffett. Berkshire’s inventory worth, ultimately test, was $634,440, so it is the very best worth of all shares in absolute {dollars}.

However that does not imply Berkshire is the costliest. It would not even imply it is costly in any respect. Relying on the earnings per share, Berkshire inventory may not be costly. If the ratio is decrease than the ratio for different shares, Berkshire is likely to be low cost in comparison with many shares although you would want to have a fortune to purchase one share.

Additionally: I tried ChatGPT’s memory function and found it intriguing but limited

In different phrases, the GPTs have not really addressed the query. The truth is, they’re lacking solely the query of valuation, the ratio, implied by the query.

The failure of each single GPT to reply that very primary query has vital implications. First, the truth that each one in every of them produces roughly the identical reply suggests they’re all drawing from some comparable false impression. That is in all probability coming from the pre-training knowledge in OpenAI’s GPT itself, which is clearly formed by some assortment of conversational knowledge that confuses share worth for valuation.

Extra necessary, the GPTs clearly do not “perceive” the query, although they’re in lots of circumstances related to a distant service that presumably is domain-specific for the investing area. Lots of the GPTs ask your permission to contact a distant host, suggesting they’re accessing a database. The truth that the applications cannot parse a really primary query means that regardless of exterior assets, nothing has been completed to refine — or “fine-tune,” because it’s referred to as — their grasp of patterns of speech within the area of stock-picking.

Additionally: The best AI chatbots: ChatGPT isn’t the only one worth trying

When the query is phrased extra particularly, about which shares have the “highest P/E,” the GPTs fail once more. They declare to not have entry to adequate real-time data — which is shocking for applications that, once more, are phoning dwelling to exterior companies. The GPTs are clearly at a primitive stage of improvement, on condition that it’s extremely simple to lookup the present P/E of any inventory by going to Yahoo! Finance and looking for that inventory. The P/E of Apple and others are listed among the many most simple details about the shares.

It is unimaginable to emphasize an excessive amount of the significance of the fundamental query of how costly or low cost a inventory is. If you cannot deal with this easy query, you actually cannot do any inventory investing in any respect. Meaning the entire inventory investing GPTs in the intervening time are ineffective. They might produce quite a lot of knowledge about corporations and shares, however nothing that will give any precious perception.

The truth that the GPTs are ineffective is shocking. In any case, inventory investing discussions about P/Es aren’t some obscure, arcane discipline of human data. The extra you look at it, the extra you see it has a reasonably repetitive set of a speaking factors and knowledge factors and a vocabulary wherein individuals converse. It isn’t rocket science, in any case.

Additionally: How to use ChatGPT’s file analysis capability (and what it can do for you)

GPTs’ massive fail within the investing enviornment makes you marvel about their broader failures. The phenomenon of hallucinations, the place applications confidently assert falsehoods, is well-known by now. The failure on this case is barely completely different. The GPTs aren’t hallucinating, however they’re repeating the frequent fallacy of complicated absolute worth in {dollars} with “costly” or “low cost.” That is not fallacious, per se, however it’s ignorant, as are many people who have not had a primary introduction to inventory investing.

Therefore, the GPTs are failing not by claiming falsehoods however by reiterating ignorance. Regardless of the GPTs are tapping into externally wants much more work — not simply higher knowledge, however a greater understanding of how buyers communicate reasonably than how individuals discuss casually about phrases like “costly” or “low cost.”

And as for the costliest tech inventory, if you wish to know, the info supplier FactSet Techniques reveals that out of three,292 North American-listed tech shares, the costliest one based mostly on P/E ratio is Houston, Texas-based Intuitive Machines, which offers quite a lot of house services, together with lunar rovers and a “trip sharing” service to make journeys to the moon extra inexpensive. It has a P/E, based mostly on this 12 months’s anticipated earnings per share, of 190.